By Steve Latin-Kasper, NTEA Senior Director of Market Data & Research

Meet our experts

This article was published in the August 2020 edition of NTEA News

Key highlights

- May new hires and layoffs data indicates we’re past the recessionary trough, but are a long way from reaching the December 2019 gross domestic product level.

- As is usually the case, economic growth is dependent on consumers — and as of July, it appears the likelihood of additional downside risk is increasing.

- Some application markets for commercial trucks and truck equipment will likely provide more opportunity for sales in the second half of 2020 than others.

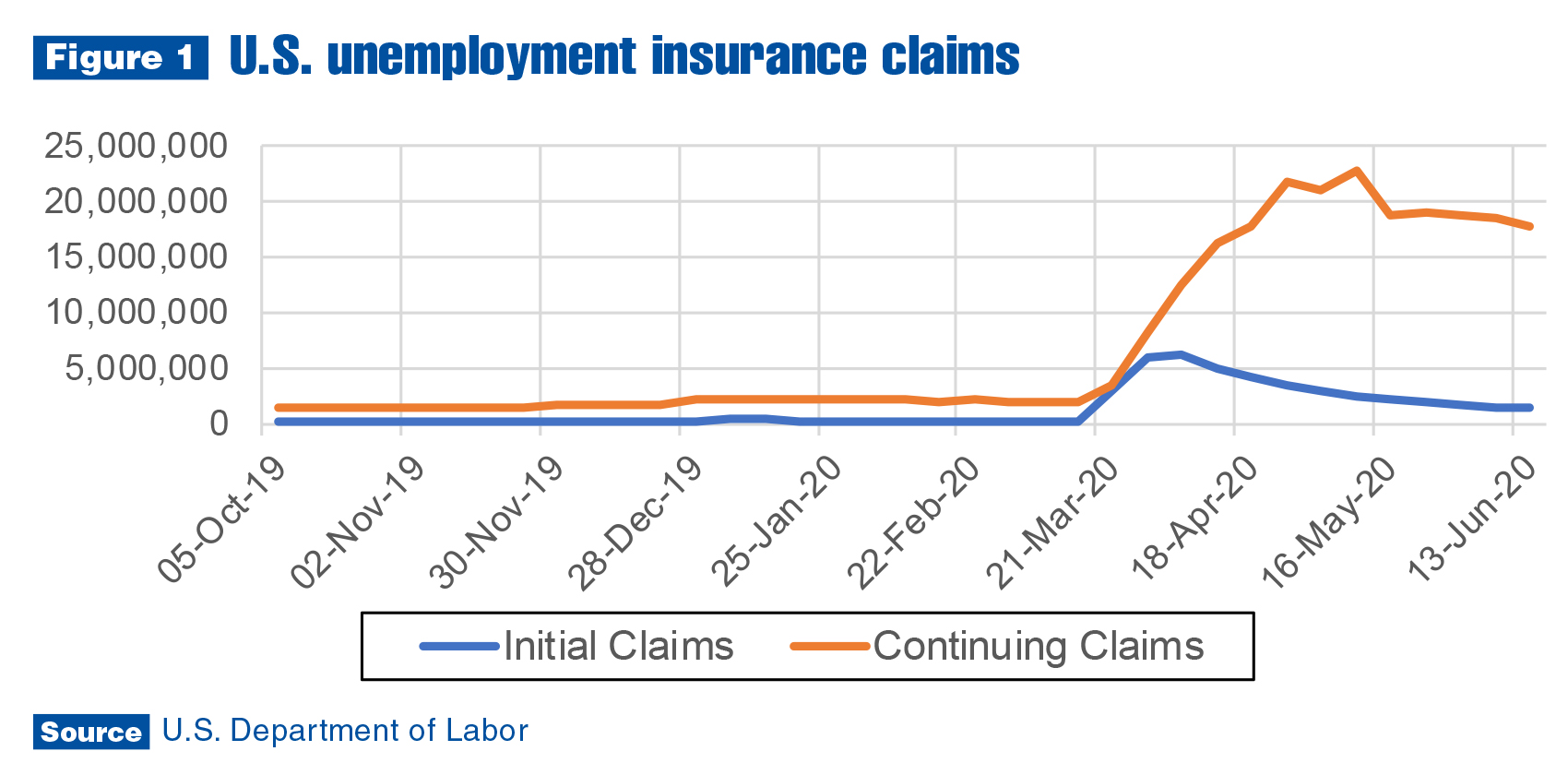

As of the beginning of July, the pandemic’s economic impact remains extremely negative, but there are some obvious signs of improvement. Figure 1 — which relates weekly initial jobless claims to continuing claims (people who filed an initial claim at an earlier date and are still receiving benefits) — shows the good and the bad.

Initial claims spiked from the third week of March through the second week of April, but have been declining on a weekly basis ever since. That’s the good news. Unfortunately, most of those who lost jobs from the third week of March to the second week of April are still unemployed (roughly 18 million as of the first week of July).

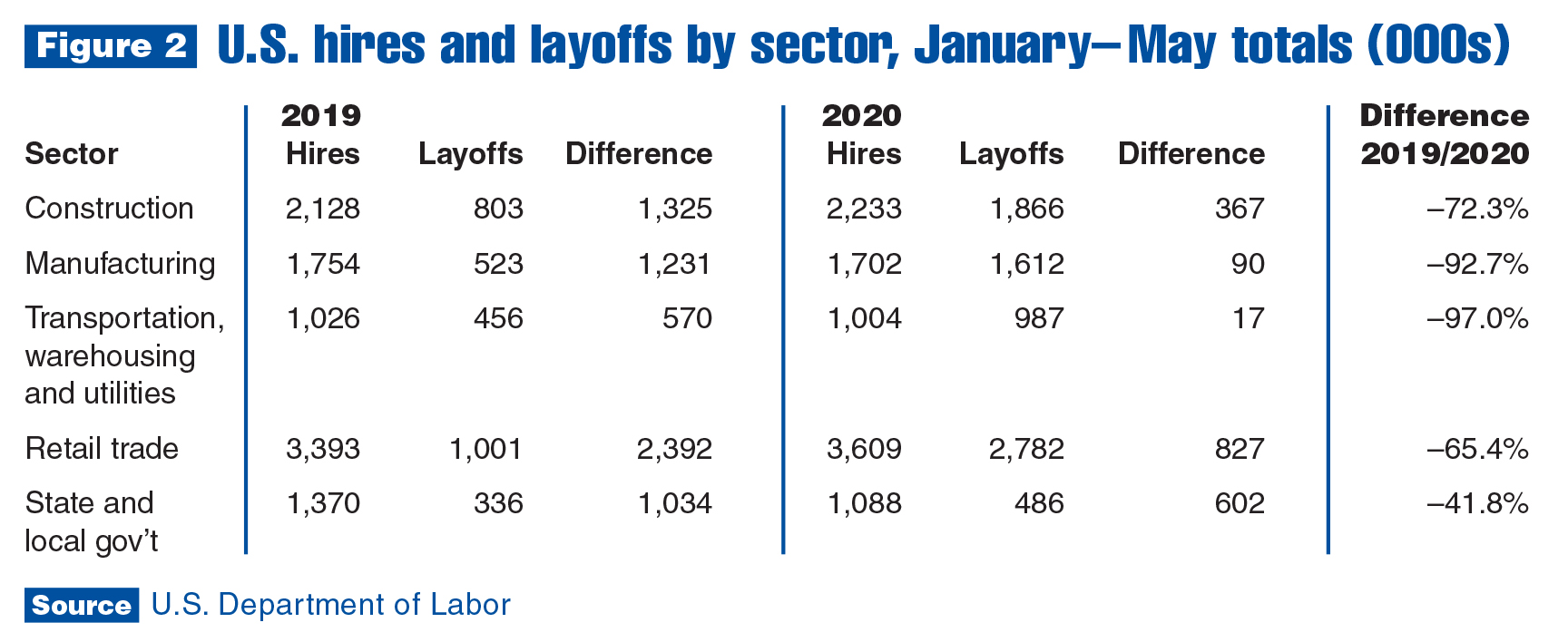

Figure 2 makes it clear new hires did not change substantially in many economic sectors in the first five months of 2020, as compared to the same period in 2019. However, the number of layoffs did change significantly in all sectors listed (and most not included in Figure 2). Hires minus layoffs are shown in the chart’s Difference columns.

What connects Figures 1 and 2 is the percent change in 2020 and 2019 differences between hires and layoffs. This calculation also shows the divergence in how the pandemic affected different economic sectors. The impact on government was not as substantial as on the private sector. Within the private sector, manufacturing and transportation/warehousing/utilities industries were affected more than construction and retail trade industries.

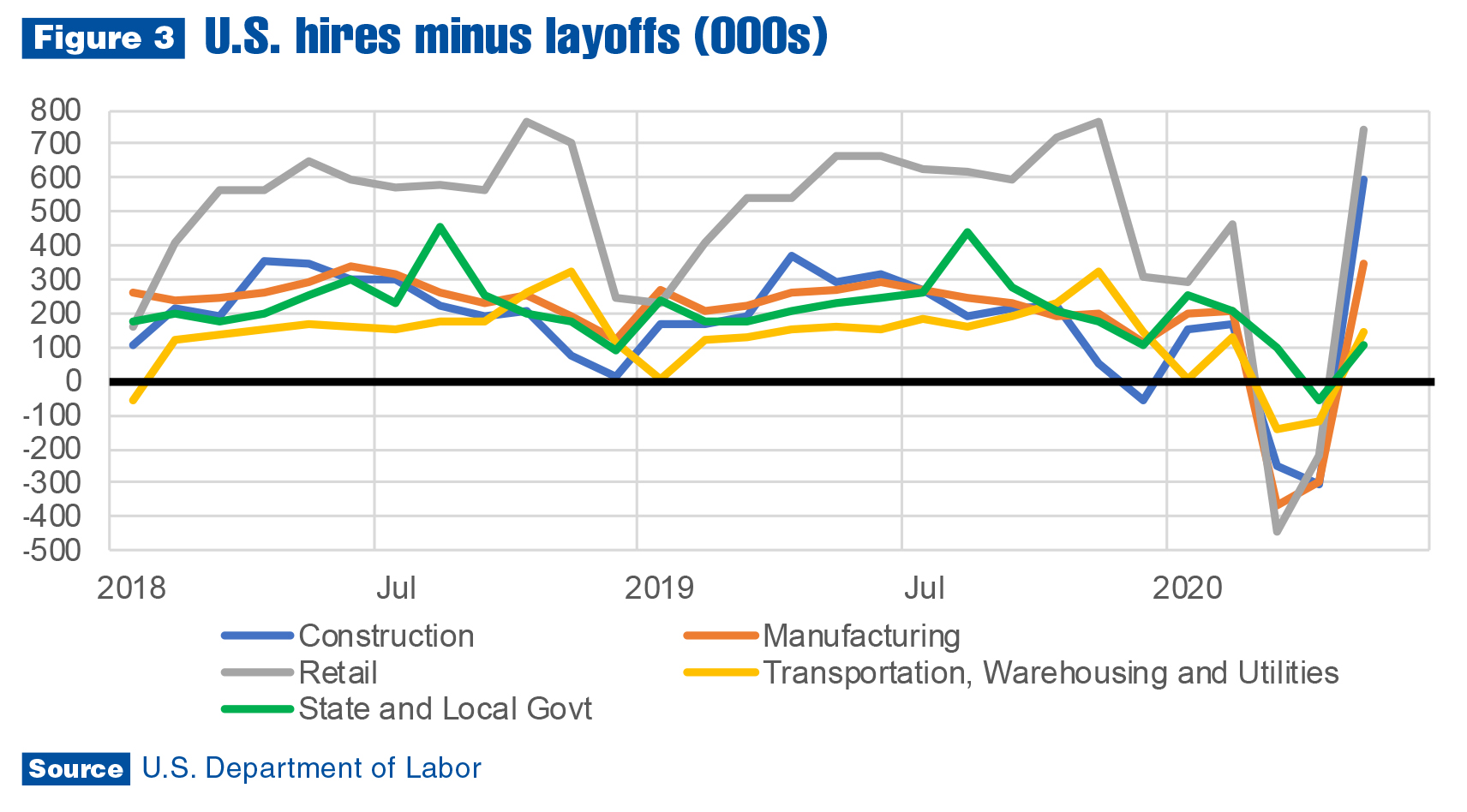

As shown in Figure 3, all of the sectors listed in Figure 2 registered net gains in payroll employment in May. However, like most other economic data, this needs to be put into perspective. The net gain in May was slightly less than 2 million — a relatively small dent in the number of people still receiving unemployment benefits. In short, May new hires and layoffs data indicates we’re past the recessionary trough, but are a long way from reaching the December 2019 gross domestic product level.

Two issues will impact the economic growth rate in the third quarter — a significant resurgence in infection rates and implementation of a new stimulus relief package. Currently, infection rates are increasing in many states, resulting in some retightening of activities. Effects of these changes haven’t yet appeared in the data, but it remains unknown how many other states will also implement more restrictions and business closures or if Congress will approve any additional economic relief.

As of July, the $600 federal addition to unemployment benefits has become a subject of debate in Congress. Some members of Congress believe the extra money has disincentivized potential laborers to return to work.

However, a number of economic analyses indicate simply ending the payments would lead to a decline in consumer expenditures.

The issue with ending the federal benefit is twofold. For many receiving it, the jobs they could return to would leave them with lower incomes than the benefit provides, which would lead to a decrease in consumer expenditures. Others may not immediately start working again, and could see their incomes decline by more than $2,000 per month, which would also lower consumer expenditures. Clearly, the federal addition to unemployment benefits has to end at some point. The question is: When? This will probably be the focus of the debate going forward.

While unlikely, it’s possible the economy could remain in recession in the third quarter. As is usually the case, economic growth will depend on consumers. As of July, it appears the likelihood of additional downside risk is increasing.

As noted previously, some application markets for commercial trucks and truck equipment will likely provide more opportunity for sales in the second half of 2020 than others. At time of publication, application markets more directly connected to consumers have the potential to grow faster than those that are not. Also, as typically happens during many recessions, there could be more chances for sales of parts and service than for new equipment and trucks.

For more economic and industry forecast information, visit ntea.com/marketdata.